Let's Discuss

Enquire NowOSN Analytics Project

Machine Learning

An application designed for a leading media conglomerate to leverage their data to reduce the customer fallout/churn, recommend payment options, find patterns in reward disbursement by the customer service executives and manage campaigns.

Rest assured, we have a strict no-spam policy.

Your inbox is safe with us!

Your inbox is safe with us!

4.6

AI Consulting Services and Advanced Data Analytics

5.0

Rated 5-stars by Satisfied customers

BUSINESS REQUIREMENT

The client approached us with the requirement for a custom automated application to perform various analyses of their service. The major areas of analysis to be performed were credit/reward disbursement, payment gateway, customer fallout, campaign management. The analysis should provide insights on various aspects of these areas.

SOLUTION

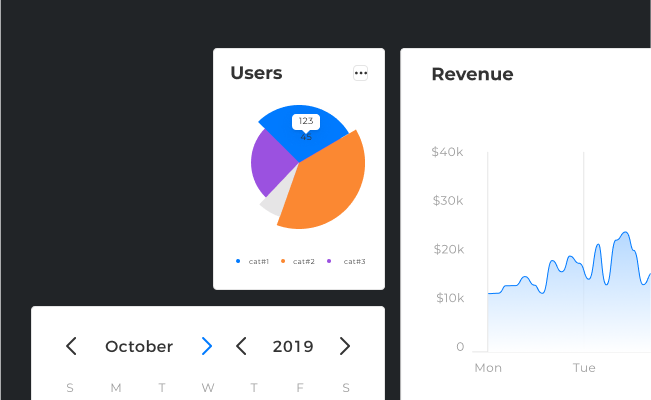

- A scalable database, right methodologies for analytics and visualization of the collected data of customers & agents were combined to meet the expectations of the client. Structured and unstructured data from standard sources like MySQL,MongoDB and files etc is stored to a scalable data storage. The data is processed on a big data platform by models designed upon DeepLearning techniques and the output is visualised over a custom build dashboard.

KEY FEATURES

- Credit Anomaly Detection & Recommender – A credit anomaly detection system that identifies the inconsistency in disbursement of credits by the customer support agents. Outcome of credits on the customer behaviour is analysed to obtain patterns to recommend optimal credit value to be offered. Agents are classified according to the credit dispersal.

- Payment Recommendation System -A predictive model to predict the preferred payment method and time. On a per user basis preferred payment option is recommended by analysing the user data with attributes like profession, income, plan etc. Predict the appropriate Payment date (the week of month) for a subscriber to minimise the chances of failed payment transactions, leveraging the user’s details and history.

- Early Life Churn Prediction – A prediction system to prevent customer fall off from a service. A customer churn score is generated for each subscriber based on their frequency of contacting customer support and the payment pattern. The subscribers that have high churn scores are observed, contacted and corrective measures are taken to avoid their churn. Churn patterns are generated after segmenting subscribers based on the churn score and their profile information to deploy marketing campaigns.

- Campaign Management – A campaign management interface to predict the acceptance of campaigns to be allotted to and learn the impact of these campaigns on the subscribers. Predict the chances of a recommended campaign being accepted and likelihood of the same causing positive/negative movements among the subscribers. Tracking the positive and negative impact of campaigns on subscribers and visualising the impact using statistical models(bar/pie/line graphs).

IMPACT

- The solution made positive effects on the business. The stakeholders could generate insights on different scenarios and make informed business decisions.

- The agents get recommendations on credit disbursements. Finally, the customers also receive recommendations in terms of channels, campaigns and payment gateways.

KEY TECHNOLOGIES

- DeepLearning4J

- Java

- JavaScript

- D3

- Tableau