Let's Discuss

Enquire NowA new competitor entered the stablecoin market on July 11th, 2021.

What are stablecoins?

Stablecoins are digital currencies with stable values that are intended to reduce price volatility by tying their value to fiat money kept in banks or to exchange-traded goods like gold. The independent auditing of stablecoins gives the bearer more confidence in their worth and dependability. Standard cryptocurrencies are not stable. Instead, stablecoins utilize the infrastructure, governance, and monetary stability of the established financial system, while utilizing the efficiency and speed of Blockchain technology.

![]()

Poundtoken

Poundtoken (GBPT), a stablecoin fully backed by British pound reserves and governed by the Isle of Man’s Financial Services Authority, has been launched by fintech company Blackfridge. The Poundtoken (GBPT) was introduced on Ethereum, but it is anticipated that it will also spread to other blockchains. As of now, GBPT is available for trading on UniSwap, Gate.io, and Bittrex Global. The Poundtoken will also provide frictionless, real-time settlements and direct GBP access to digital asset markets.

Segregated payment accounts that are independently audited will safeguard customer funds and guarantee total segregation from the company’s own assets. The independent attestation services will be offered by appointed auditors to certify that the stablecoin’s collateral is at least 100 per cent.

The Journey Of A Direct User

- Direct consumers are subject to legal and regulatory requirements for due diligence. Onboarding new customers directly are accessible through the internet service poundtoken.io.

- A minimum of one corporate bank account will be verified by customers. Only funds from the client’s confirmed corporate account will be accepted. To deposit money, each customer is given a special Reference Code. When transferring money from a verified corporate account, the Documented Process must be included.

- The Segregated Client Funds Account receives funds directly. After receipt and reconciliation, the consumer receives the GBPT with fewer fees. Before any money is sent, charges are calculated and published on the platform.

- Customers that have submitted the necessary due diligence paperwork can attach their personal ERC-20 wallet addresses. The platform allows users to transfer their remaining GBPT value to a linked wallet (s).

- Following then, GBPT usage here on the blockchain is monitored. Blockchain analytics software verifies every ERC-20 wallet that receives GBPT. When the risk exceeds a predetermined threshold, the company will look into it and take appropriate action.

- Customers can deposit the GBPT to the network for redemption by using a special deposit address they will receive.

- Within 21 days of the stablecoin balance being added, the company will advise the user to either withdraw their GBPT balance to their own wallet or redeem it for GBP.

- Redeeming GBPT for GBP is done through the platform, and once it has been approved, the fiat is sent to the user’s verified bank account.

The Marketing Strategy and Methods

The marketing strategy will be focused on the B2B sector initially and may extend to the B2C sector in the long term. The initial objective is to focus on key markets to drive the adoption of GBPT before targeting retail sectors with use cases for GBPT.

There are various use cases with significant transaction markets already as the ecosystem for digital currencies continues to develop.

Near-term use cases:

- Money Transfers: Stablecoins are digital assets that can be quickly and securely moved to anyone at any time, acting as a reliable means of exchange with a fiat-based peg for the benefit of the world economy.

- Store of value: During times of high volatility, retail and institutional traders frequently safeguard downside moves by converting them into an asset with a steady value. While the majority of digital currencies are volatile, GBPT offers nearly immediate exchanges without the drawbacks of fiat translation.

- On-ramp for digital assets and Def: A growing number of financial services and assets will be provided by or even originate from the blockchain.

- Fiat Equivalent for Trading: For both institutional and retail traders, using currency trading tactics to gain yield or hedge positions is a common practice. Traders will be able to use these tactics in conjunction with the benefits of the blockchain-based currency when we add more currency pairs.

Longer-term use cases:

- Blockchain-based Fx markets: Stablecoin Fx markets may emerge as a result of the expansion of stablecoins secured by various currencies.

- Blockchain-based banking: It supplies a variety of consumers with lending and saving products.

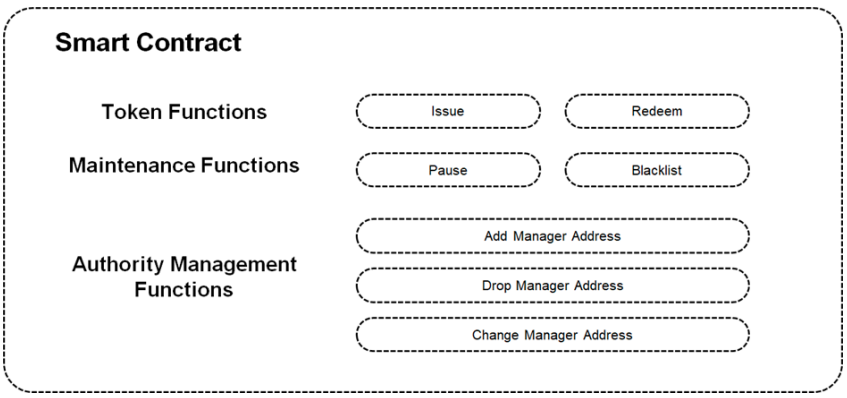

Smart Contract

Having a 1:1 reserve stored at a recognized financial institution is one of the most important requirements for the success of digitizing different currencies. Poundtoken.io is based on the Ethereum DLT and uses smart contracts to make it easier to buy, store, and send the stablecoin while also transparently collateralizing it (the total quantity in circulation is visible to the public).

The data integrity and proper operation of the computer-based procedure are kept unchanged since these transactions are traceable and irreversible. The ERC-20-based smart contract used by Poundtoken.io ensures that our stablecoin runs in accordance with predetermined guidelines in a predetermined order, reducing the possibility of human mistakes. Poundtoken.io can be integrated and supported immediately by most digital asset trading, storage, and transfer venues that support the ERC-20 protocol.

Transactions in this virtual currency occur on the Ethereum platform without the use of third-party financial intermediaries, with poundtoken.io acting as the issuing and redemption mechanism.

The Figure below shows the functions of the smart contracts.

The issue contract’s goal is to send a certain quantity of stablecoin to a given address (user). Every time a new issue order is received, the AML verification procedure will be initiated. The Redeem contract’s goal is to redeem a predetermined quantity of stablecoin from a given address (user).

Numerous stablecoin issuers have also expanded their product offerings, with top providers Circle and Tether planning to introduce currencies backed by the euro and peso, respectively. As stablecoins are increasing, decentralised flows will also increase significantly. The advantages of stablecoins always put them ahead of the other cryptocurrencies.

At Dexlock, our significant experience in blockchain provides you with the best team of people to help you realize your crypto dreams. Connect with us here for more crypto-related queries.

Disclaimer: The opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Dexlock.